You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stocks to watch

- Thread starter broke'n'nuts

- Start date

jhurkot

Active VIP Member

fredw

Active VIP Member

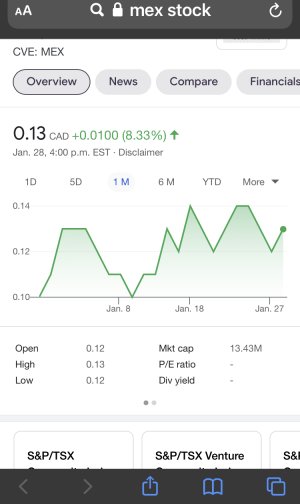

Bid to ask as of now.. they got her back up

Andrew.renegade1000

Active VIP Member

Don’t miss this ride!!!!, gona be like a buck$ or two$ real soon, read up on this one or just keep it on ur watch list for fun.

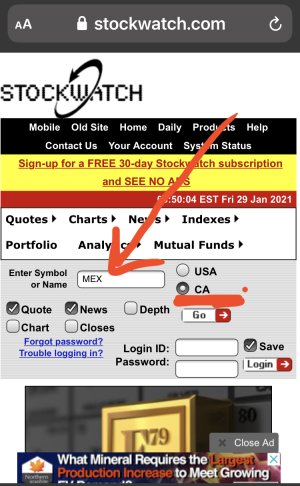

View attachment 232196View attachment 232197

Why do you think it’s going to rise so much? Very new to stocks and thinking that looks like a low risk option to get in on?

jhurkot

Active VIP Member

Why do you think it’s going to rise so much? Very new to stocks and thinking that looks like a low risk option to get in on?

If you're just getting into stocks you'll definitely wanna go all in on $GME and $AMC.

- Moderator

- #406

Bogger

Bogger of the GBCA

Gamestop holding at $350USD..... tough pill to swallow for $5 shorts - 6900% loss. Shorts still account for 122% of all stock and from what I've read a LOT of those need to be reconciled by close of trading today. Interesting times.

ABMax24

Active VIP Member

Gamestop holding at $350USD..... tough pill to swallow for $5 shorts - 6900% loss. Shorts still account for 122% of all stock and from what I've read a LOT of those need to be reconciled by close of trading today. Interesting times.

Is it possible to have those deadlines extended? In extenuating circumstances like this?

Seems that would be the best way for brokers to get the shares back, the reality is a bunch of these short sellers will go bankrupt today otherwise.

jhurkot

Active VIP Member

I hear ya, we are down to just the mortgage and a car payment at 0.9% so at this point I don't have debt to worry about. $6.95 is better then my $9.98 but I went with RBC because that's where all our banking is and they have been decent to us... but hey keep CIBC busy because that was the bank stock I decided to go with, been good over the past 6 months. My accounts are TFSA & RRSP and I figure if I can build a 6 figure nest-egg in there over the next 10-15 years then retirement will be a little more comfortable. We have 10 years left on the mortgage then after that I'll pound that $5000/mth into my self directed TFSA in dividend stocks for a few years.... I know I know with interest rates so low why worry about pounding down a mortgage, the answer to that is Because I want too.

I'm surprised CIBC is doing that well, they are brutal to deal with i'm honestly just too lazy to move and spend the time to get everything I have with CIBC elsewhere. I use to be that thinking if the debt is cheaper then what you can invest for it makes sense but it's changed. Getting my vehicles and all my company equipment/vehicles paid for it feels awesome to know it's yours and don't owe anyone a dime and the reason so many financial people recommend paying off debt prior to investing. At the worst, I had about $20k a month in fixed expenses and even though you got enough money coming in, it's still pretty stressful so it's a lot better to have it around $12k.

Is it possible to have those deadlines extended? In extenuating circumstances like this?

Seems that would be the best way for brokers to get the shares back, the reality is a bunch of these short sellers will go bankrupt today otherwise.

I don't know SFA about investing but I wouldn't be surprised if the hedge funds pull some kind of string to do so. I mean look at robinhood, that chit is criminal. That takes a lot of pull to get someone to self destruct their company. I would be shocked if there isn't a massive fallout for whoever pulled the strings, doesn't matter if it's left or ring wing there is outlets saying the same thing, democrats and republicans agreeing which means something is very wrong.

Last edited:

Cdnfireman

Active VIP Member

I'm surprised CIBC is doing that well, they are brutal to deal with i'm honestly just too lazy to move and spend the time to get everything I have with CIBC elsewhere. I use to be that thinking if the debt is cheaper then what you can invest for it makes sense but it's changed. Getting my vehicles and all my company equipment/vehicles paid for it feels awesome to know it's yours and don't owe anyone a dime and the reason so many financial people recommend paying off debt prior to investing. At the worst, I had about $20k a month in fixed expenses and even though you got enough money coming in, it's still pretty stressful so it's a lot better to have it around $12k.

Good plan. You’ll never regret being debt free.

Cdnfireman

Active VIP Member

Is it possible to have those deadlines extended? In extenuating circumstances like this?

Seems that would be the best way for brokers to get the shares back, the reality is a bunch of these short sellers will go bankrupt today otherwise.

That might not be a bad thing.

AreWeThereYet

Active VIP Member

Is it possible to have those deadlines extended? In extenuating circumstances like this?

Seems that would be the best way for brokers to get the shares back, the reality is a bunch of these short sellers will go bankrupt today otherwise.

https://www.investopedia.com/ask/answers/05/shortsaleclosed.asp

The people lending the shares will want their money

- Moderator

- #414

Bogger

Bogger of the GBCA

https://www.investopedia.com/ask/answers/05/shortsaleclosed.asp

The people lending the shares will want their money

I had read somewhere that a lot of the shorts on GME were on contract an set to expire at market close January 29 and that is why it was timed for this week...… but I don't know the source and can't even remember which website or forum I read that on...

I don't know SFA about investing but I wouldn't be surprised if the hedge funds pull some kind of string to do so. I mean look at robinhood, that chit is criminal. That takes a lot of pull to get someone to self destruct their company. I would be shocked if there isn't a massive fallout for whoever pulled the strings, doesn't matter if it's left or ring wing there is outlets saying the same thing, democrats and republicans agreeing which means something is very wrong.

I heard Robin hood got a call from the White House pressuring them to act yesterday.

I heard Robin hood got a call from the White House pressuring them to act yesterday.

Just looked that up, wouldn't be surprised. However seems odd that some dems were speaking out against it.

Last edited:

Just looked that up, wouldn't be surprised. However seems odd that some dems were speaking out against it.

I can't confirm it, but just because AOC speaks out against it on twitter doesnt mean biden gives a fuk.

The White House is bought and payed for by wall street types.

Lunch_Box

Active VIP Member

jhurkot

Active VIP Member

Anybody holding GME or AMC over the weekend?

You know it.

Similar threads

- Replies

- 5

- Views

- 5K

- Replies

- 2

- Views

- 3K