- Staff

- #1

- Joined

- Oct 21, 2006

- Messages

- 48,082

- Reaction score

- 32,189

- Location

- Edmonton/Sherwood Park

- Website

- www.bumpertobumper.ca

December 10, 2024

Adam Malik

Canadians’ appetite for zero-emission vehicles has yet to wane as another new high was hit for new registrations of battery and plug-in hybrid electric vehicles.

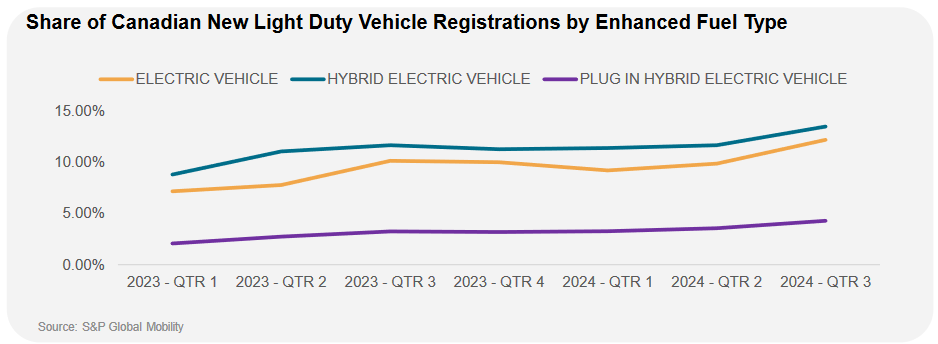

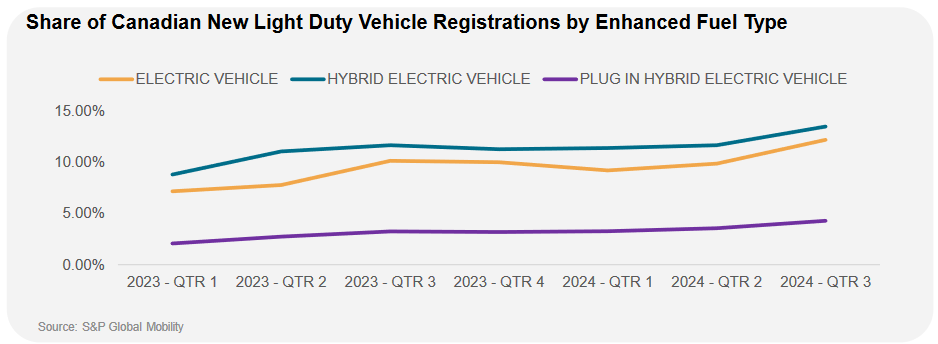

Third-quarter data from S&P Global Mobility show that 16.5 per cent of new vehicle registrations in Canada were ZEVs. That’s a 3.1-point increase, or 14 per cent, from the 13.4 per cent in the second quarter.

The group reported a 15.1 per cent rise in BEVs and a 12.4 per cent jump in PHEVs.

Internal combustion engine still dominated overall new vehicle registrations, but its penetration fell from 75% in Q2 to 70 per cent in Q3.

S&P Global Mobility pegged 2024 full-year adoption rates to come in above 15 per cent, reaching 266,889 units. And it sees a continued upward trajectory in the coming years.

“This growth is projected to continue, with adoption rates rising to 19.0 per cent in 2025, 25.3 per cent in 2026, and 30.7 per cent in 2027,” its report said.

That said, S&P Global Mobility did warn of potential headwinds that could get in the way of growth.

“However, several risks could impact these projections, including the pace of charging infrastructure development, economic fluctuations influencing consumer purchasing power, potential changes in government policies or incentives and technological advancements,” it noted. “Addressing these risks will be crucial to achieving the forecasted growth and maintaining the momentum in ZEV adoption.”

Of note, hybrids made up 13.5 per cent of new vehicle registrations; BEVs were 12.3 per cent. After the gap between the two expanded to 2.4 percentage points at the start of this year, it has narrowed to 1.2 percentage points.

Quebec, which will phase out purchase incentives for ZEVs, led the country with a 34.6 per cent adoption rate, up from 28.4 per cent in Q2. British Columbia came in second at a 29.4 per cent adoption rate. Yukon rounded out the top three with a 10.3 per cent adoption rate, but it was the only region to see a drop compared to the precious quarter (12.3 per cent).

Ontario (9 per cent) placed fifth while Prince Edward Island came fourth (9.6 per cent).

In the three biggest cities, Montreal saw ZEV adoption rise from 22.2 per cent in 2023 to 32.8 per cent in 2024. Vancouver stayed mostly stead but still slaw a slight decline from 27.1 per cent in 2023 to 26.9 per cent. Toronto saw a modest rise, going from 9.2 per cent in 2023 to 9.6 per cent in 2024.

Tesla led the market with 15.2 per cent more sales from Q2. Chevrolet spiked 138 per cent, which S&P Global Mobility credited to its Bolt EV and EUV. Toyota’s ZEV sales jumped by 72.2 per cent thanks to the Prius Prime and RAV4 Prime. Hyundai’s Kona Electric and Ionic 5 helped push towards a 2.81 per cent increase, supported by the Kona Electric and Ioniq 5.

The group also highlighted Mercedes’ 99.31 per cent rise and VinFast’s 66.52 per cent jump as they expand their presence in the Canadian ZEV market.

Another new high for ZEV sales in Canada

Electric Vehicles, Market Research & Statistics, OE newsAdam Malik

Canadians’ appetite for zero-emission vehicles has yet to wane as another new high was hit for new registrations of battery and plug-in hybrid electric vehicles.

Third-quarter data from S&P Global Mobility show that 16.5 per cent of new vehicle registrations in Canada were ZEVs. That’s a 3.1-point increase, or 14 per cent, from the 13.4 per cent in the second quarter.

The group reported a 15.1 per cent rise in BEVs and a 12.4 per cent jump in PHEVs.

Internal combustion engine still dominated overall new vehicle registrations, but its penetration fell from 75% in Q2 to 70 per cent in Q3.

S&P Global Mobility pegged 2024 full-year adoption rates to come in above 15 per cent, reaching 266,889 units. And it sees a continued upward trajectory in the coming years.

“This growth is projected to continue, with adoption rates rising to 19.0 per cent in 2025, 25.3 per cent in 2026, and 30.7 per cent in 2027,” its report said.

That said, S&P Global Mobility did warn of potential headwinds that could get in the way of growth.

“However, several risks could impact these projections, including the pace of charging infrastructure development, economic fluctuations influencing consumer purchasing power, potential changes in government policies or incentives and technological advancements,” it noted. “Addressing these risks will be crucial to achieving the forecasted growth and maintaining the momentum in ZEV adoption.”

Of note, hybrids made up 13.5 per cent of new vehicle registrations; BEVs were 12.3 per cent. After the gap between the two expanded to 2.4 percentage points at the start of this year, it has narrowed to 1.2 percentage points.

Quebec, which will phase out purchase incentives for ZEVs, led the country with a 34.6 per cent adoption rate, up from 28.4 per cent in Q2. British Columbia came in second at a 29.4 per cent adoption rate. Yukon rounded out the top three with a 10.3 per cent adoption rate, but it was the only region to see a drop compared to the precious quarter (12.3 per cent).

Ontario (9 per cent) placed fifth while Prince Edward Island came fourth (9.6 per cent).

In the three biggest cities, Montreal saw ZEV adoption rise from 22.2 per cent in 2023 to 32.8 per cent in 2024. Vancouver stayed mostly stead but still slaw a slight decline from 27.1 per cent in 2023 to 26.9 per cent. Toronto saw a modest rise, going from 9.2 per cent in 2023 to 9.6 per cent in 2024.

Tesla led the market with 15.2 per cent more sales from Q2. Chevrolet spiked 138 per cent, which S&P Global Mobility credited to its Bolt EV and EUV. Toyota’s ZEV sales jumped by 72.2 per cent thanks to the Prius Prime and RAV4 Prime. Hyundai’s Kona Electric and Ionic 5 helped push towards a 2.81 per cent increase, supported by the Kona Electric and Ioniq 5.

The group also highlighted Mercedes’ 99.31 per cent rise and VinFast’s 66.52 per cent jump as they expand their presence in the Canadian ZEV market.