- Staff

- #1

- Joined

- Oct 21, 2006

- Messages

- 48,070

- Reaction score

- 32,180

- Location

- Edmonton/Sherwood Park

- Website

- www.bumpertobumper.ca

September 18, 2024

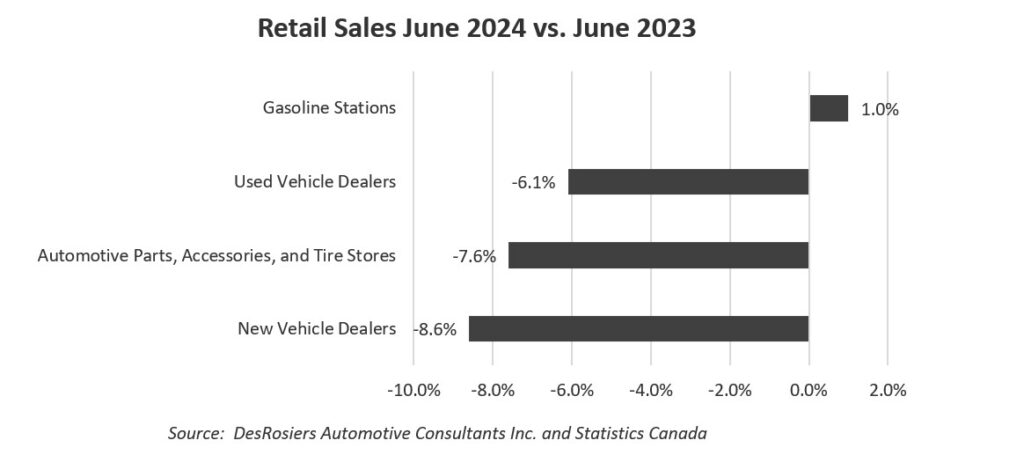

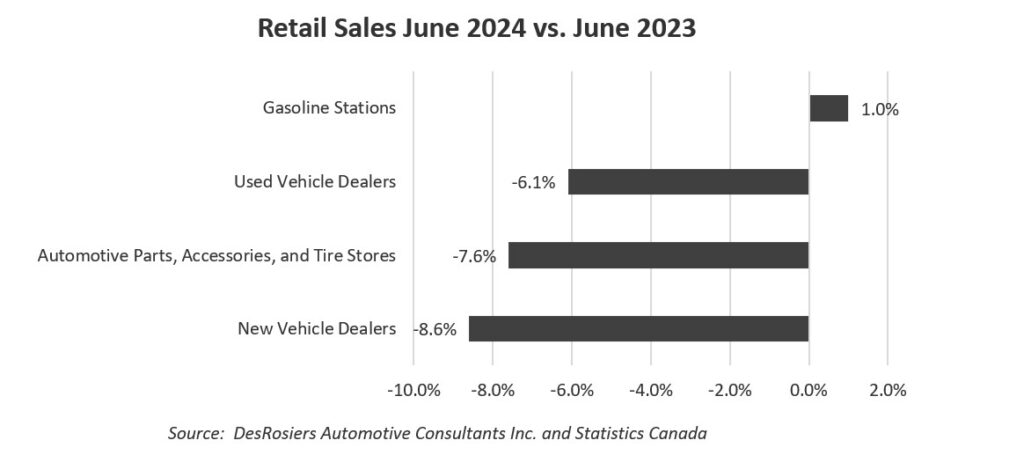

June’s automotive retail sales data revealed notable declines across various segments, including those in the aftermarket, raising concerns within the industry.

DesRosiers Automotive Consultants (DAC) reported a “worrying” drop in automotive retail sales for June, with declines observed across multiple segments.

New vehicle dealers led the way with an 8.6 per cent decrease in sales compared to the same month last year, while used vehicle dealers saw a 6.1 per cent decline.

The aftermarket also saw a significant drop-off. Automotive parts, accessories and tire stores reported a 7.6 per cent decrease in sales for June 2024 compared to June 2023. DesRosiers noted that even though monthly data can be volatile, the scale of the decline is alarming, especially considering the impact of the CDK software outage that affected the industry in June.

Despite the troubling June figures, the consultancy noted that the first half of 2024 showed more stability in the automotive retail sector.

Used vehicle dealers recorded a 0.9 per cent increase in sales, while new vehicle dealers saw a slight 0.5 per cent rise. Conversely, gasoline stations experienced a minor 0.4 per cent decrease in retail sales.

Automotive parts, accessories and tire stores fell behind the pack with a 1.1 per cent decline — however, that number comes off the record high sales seen in the first half of 2023.

“Retail sales have remained stable in the first half overall and have maintained high dollar value figures, but June itself has shown notable weakness,” commented Andrew King, Managing Partner at DAC.

Why there’s concern over falling auto retail numbers

June’s automotive retail sales data revealed notable declines across various segments, including those in the aftermarket, raising concerns within the industry.

DesRosiers Automotive Consultants (DAC) reported a “worrying” drop in automotive retail sales for June, with declines observed across multiple segments.

New vehicle dealers led the way with an 8.6 per cent decrease in sales compared to the same month last year, while used vehicle dealers saw a 6.1 per cent decline.

The aftermarket also saw a significant drop-off. Automotive parts, accessories and tire stores reported a 7.6 per cent decrease in sales for June 2024 compared to June 2023. DesRosiers noted that even though monthly data can be volatile, the scale of the decline is alarming, especially considering the impact of the CDK software outage that affected the industry in June.

Despite the troubling June figures, the consultancy noted that the first half of 2024 showed more stability in the automotive retail sector.

Used vehicle dealers recorded a 0.9 per cent increase in sales, while new vehicle dealers saw a slight 0.5 per cent rise. Conversely, gasoline stations experienced a minor 0.4 per cent decrease in retail sales.

Automotive parts, accessories and tire stores fell behind the pack with a 1.1 per cent decline — however, that number comes off the record high sales seen in the first half of 2023.

“Retail sales have remained stable in the first half overall and have maintained high dollar value figures, but June itself has shown notable weakness,” commented Andrew King, Managing Partner at DAC.